Review the termsīoth parties should carefully review the document to ensure they’re willing to accept the terms of the loan. Make sure to include important information like the terms of the loan, the date of the transaction, each party’s mailing address and any other relevant information you may need. You can draft it yourself, and you might want to consider a promissory note template available online. This prevents debts from being sold to a debt collection agency, for example.

Typically, interest rates are higher for unsecured loans. Unlike secured promissory notes, unsecured ones aren’t backed by physical property. Unsecured: Unsecured loans rely on the good faith and credit of the borrower instead of collateral.Auto loans and mortgages are common types of secured loans. In the event of default, the lender can seize the collateral. Secured: Secured loans involve collateral, which is property the borrower can use to back up the loan.A master promissory note is one of many types of student loans that borrowers use to pay for college. Master: The Department of Education issues master promissory notes to originate student loans.Most promissory notes share similar characteristics, but there are some notable differences: Instead of a verbal agreement (or even an IOU), which are easier to dispute in the event of a disagreement, promissory notes hold each side of the loan accountable.įor more significant loans, a loan contract may be a better alternative. Promissory notes protect not only the lender but the borrower as well. Generally, they’re used for smaller loan amounts or loans between individuals. If they don’t, the lender could take them to court. If the business fails, for whatever reason, the borrower would still have to abide by the loan’s terms. Even if the new entrepreneur is borrowing money from a friend, that friend may still want to ensure the debt will be repaid. This offers the lender more protection than a simple verbal agreement. Once the borrower and lender sign the document, both will have to abide by those terms. If an individual wants to give someone a loan - perhaps to help them start a small business - they may agree to use a promissory note instead of having a lawyer draft a contract. While they may not be as detailed as a formal loan contract, which banks and loan companies tend to use, promissory notes still are legally enforceable and give the borrower an obligation to repay the loan according to the terms laid out in the document. Individuals, businesses and other entities use them for loan agreements. For example, a promissory note between a home seller and buyer should have information about the property, such as the property’s address or its appraised value.įor secured loans, the promissory note may also contain specific details about what would happen if the loan goes into default (like a potential foreclosure). The specific information in the written agreement may depend on how the loan is used. Amount of money borrowed (also known as the principal).Not every promissory note is exactly the same, but they often include similar information related to the terms of a specific loan.

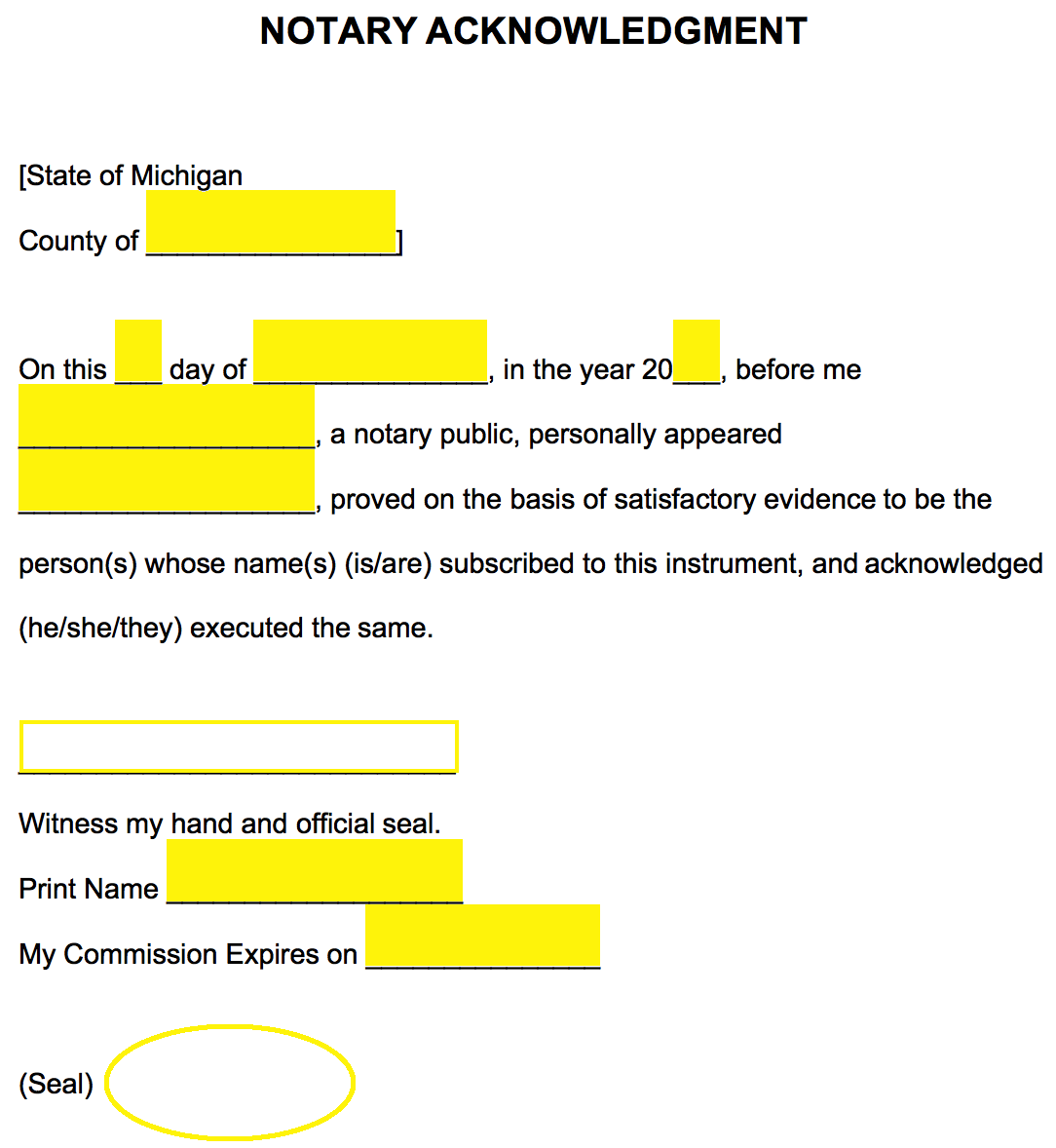

Does a promissory note need to be notarized how to#

How to make changes to a promissory note.

0 kommentar(er)

0 kommentar(er)